What happens when markets flip the script? – TVO MB 3-28

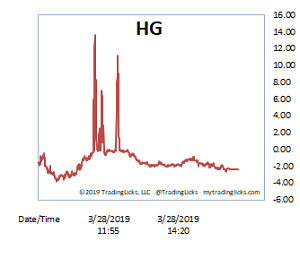

The Heat Gauge was in CHILLY territory for most of the session on Thursday, and once again the bulls have regained control in the fight for S&P 2800. Earlier in the day, the bears managed to get in a few large down volume spikes, but it’s looking like it may just be the last of the weak hands jumping ship, rather than a warning of more selling to come.

Overall volume fell and that’s exactly what the bulls want to see at this point. Too much of a boost here could very well cause the tide to aggressively shift.

At their very best, the bulls nature of buying is slow and steady, while the bears specialize more in sprinting… A slow, low volume grind up, followed by a quick fall (then rinse and repeat), is the natural order of the market.

Each side is equally good at what they do in different ways. When either side starts to reverse their roles, though, that’s when the balance gets disrupted and chaos develops. We’re not out of the woods yet at 2800, but for now it seems that both bulls and bears are sticking to the script. -MD

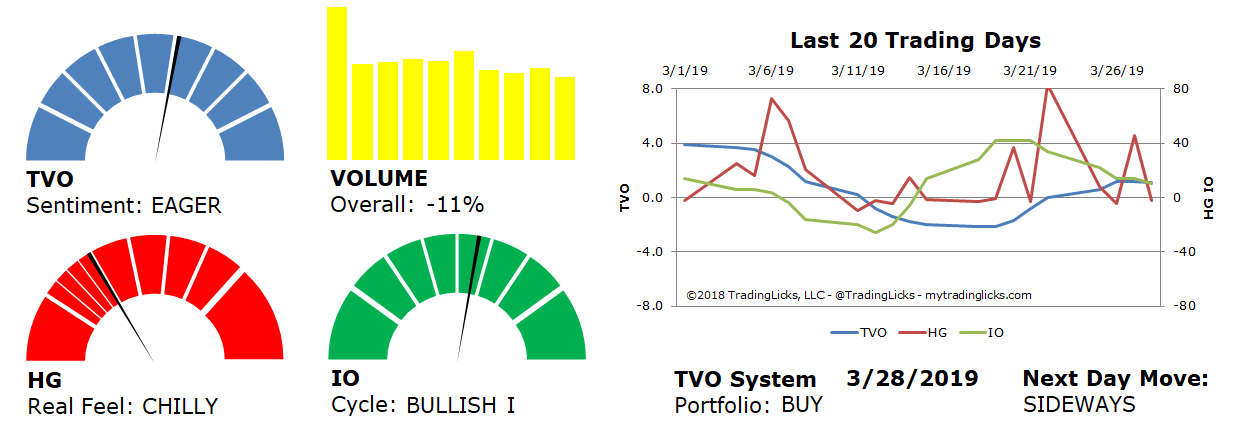

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: -11% – Today’s volume was lower than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: BULLISH I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.