TVO Market Barometer 8-03: What is driving this market? TVO knows.

Overall volume fell last Friday as markets continued to do what they’re “not supposed to do” in the wake of trade wars and tariffs and proceeded to get one more step closer to all-time highs.

The media (social and otherwise) seems to have the demise of this market in its sights, but the smart money has other plans at this point. Accumulation has fueled the current move since the end of the month last Tuesday and the question is how long will it last.

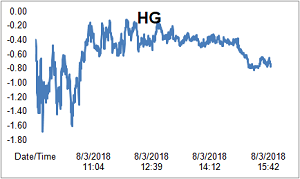

TVO, our volume oscillator, has lately been on a downward trajectory, however, the oscillator has been stuck at the same value for the last 3 sessions. Depending on the volume action on Monday, we could reverse back the other way, which could very well be setting the stage for more accumulation to come.

So does that mean he S&P 500 is ready to break out to new highs and never look back? Well, in the short-term, profit taking during a run-up is vital to keeping your portfolio in the black. Last Friday we did exactly that and sold our SPY calls for a +32% gain, bringing our total account return to just over +4% for the year.

So if trade war fears are not enough to take down this market, what is? Well, the media has got it right in one sense… there’s plenty of fear out there. But the biggest fear of all, and the one that really drives the market (and a good portion of human behavior for that matter) is the fear of missing out (FOMO). If investors start to feel like the train is leaving without them in it, there isn’t a tariff, trade war or trillion-dollar company that will prevent them from buying a last-minute ticket on that ride. -MD

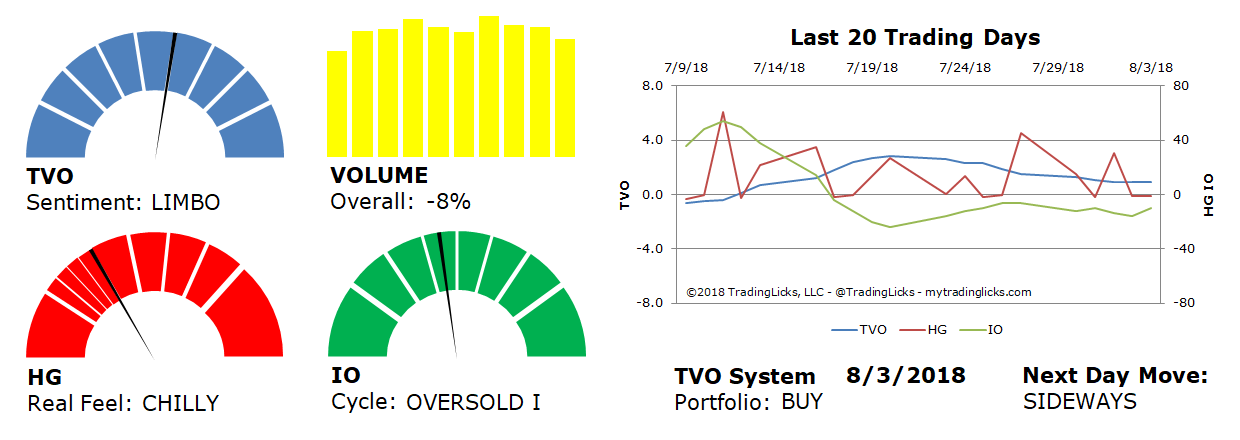

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -8% – Today’s volume was lower than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.