TVO Market Barometer 7-17: Good things come in threes… or do they?

After weaker than expected earnings, Netflix plunged Tuesday morning, only to be feverishly bought up by the afternoon. For some reason, the drop was viewed as a buying opportunity and now things are all good.

Also on Tuesday, the day after Trump appeared to side with the Russians, the futures tanked in the AM, only to reverse into a furious rally posting positive gains for all major indices at the close. For some reason, just one misspoken word later and we have yet another buying opportunity.

Again, we’re all good.

So is the lesson here that whenever there’s bad news you should buy instead of short the market? Well, maybe sometimes, but what if bad news really is bad news (maybe it’s all just bad news), and how do you really know for sure?

The answer is you don’t, which is why we focus on technicals (in our case, volume) and ignore news altogether.

So with that said, we closed our SPY position today from Friday for a +5% gain, putting our overall account within 3% of being flat for the year and close to completely recovering from an 18% drawdown (which may seem daunting, but every year the TVO System has consistently snapped back from similar setbacks).

So now that we’ve had 3 wins in a row, it’s time to ramp up the game in order to make up for lost ground, right? Well, not exactly.

Three is a very crucial number in trading from a psychological standpoint. It’s usually after 3 straight losses that folks lose their confidence and quit, often right before the one that makes them all up. After 3 wins they feel invincible and proceed to overload up on number four… the one that not only ends up killing the streak, but also ends up wiping out all the gains.

Knowing the success rate of your system (65% overall win rate, in the case of TVO) and having a carefully measured method of position sizing is what will ensure, no matter what happens, that you’ll live to trade another day.

The Nasdaq did see a bit of accumulation on Tuesday, so a shakeout may be on tap very soon with the Fed Chair on Wednesday as a potential catalyst. Will bad news turn out to be all good once again? Next Day Move says SIDEWAYS, so we’re not exactly counting on it this time. -MD

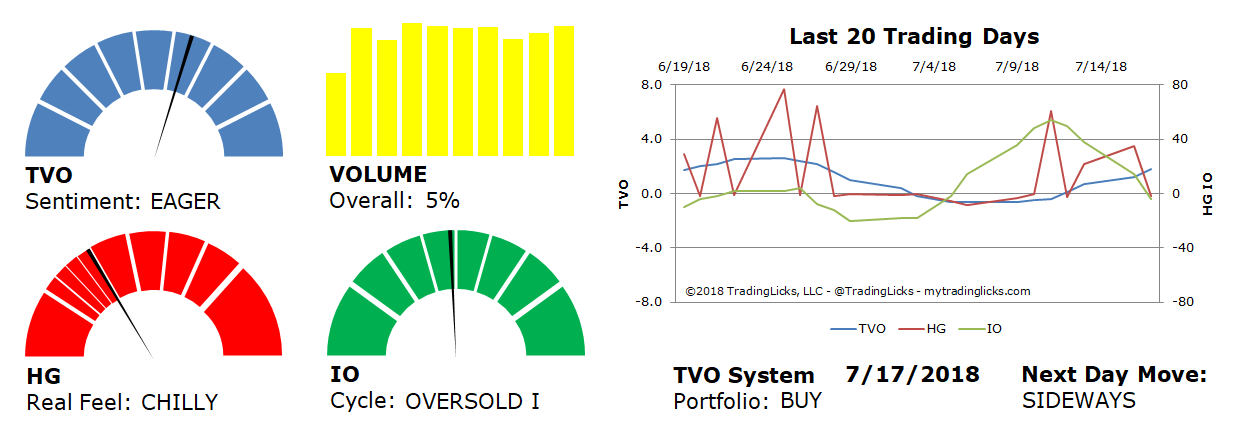

Sentiment: EAGER – Markets are in accumulation mode and big institutions are buying at a slow and steady pace.

Volume: 5% – Today’s volume was higher than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.