TVO Market Barometer 7-02: When investors are away, the bulls will play.

Markets close early the day before the 4th of July, presumably to give investors and financial folks a head start on their holiday travel plans.

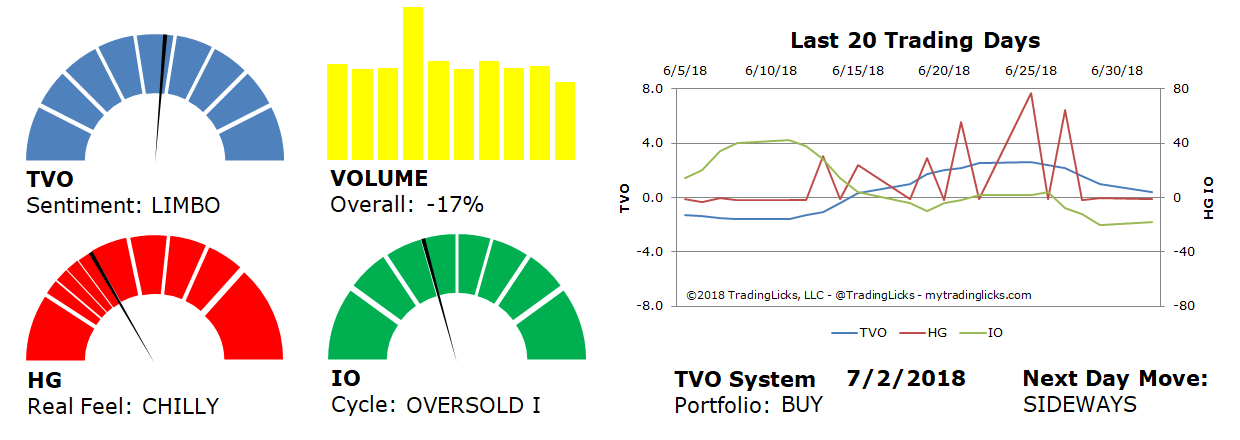

Looking at volume on the 2nd of July, however, the overall drop of -17% seems to suggest vacation mode is already well underway.

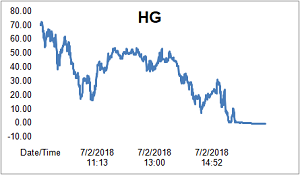

It was a positive day for the bulls, though, (Our Heat Gauge went from SCORCHING at the open to CHILLY at the close) as the 50 day MA on SPY was solidly reclaimed.

A lack of market participants does generally favor the default direction of the stock market (which is, of course, to go up), so the bulls may want to control their optimism… at least until after the FOMC minutes this Thursday. And depending on how things go, Friday’s session could give Wednesday’s fireworks display a run for the money. -MD

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -17% – Today’s volume was lower than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 52%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.