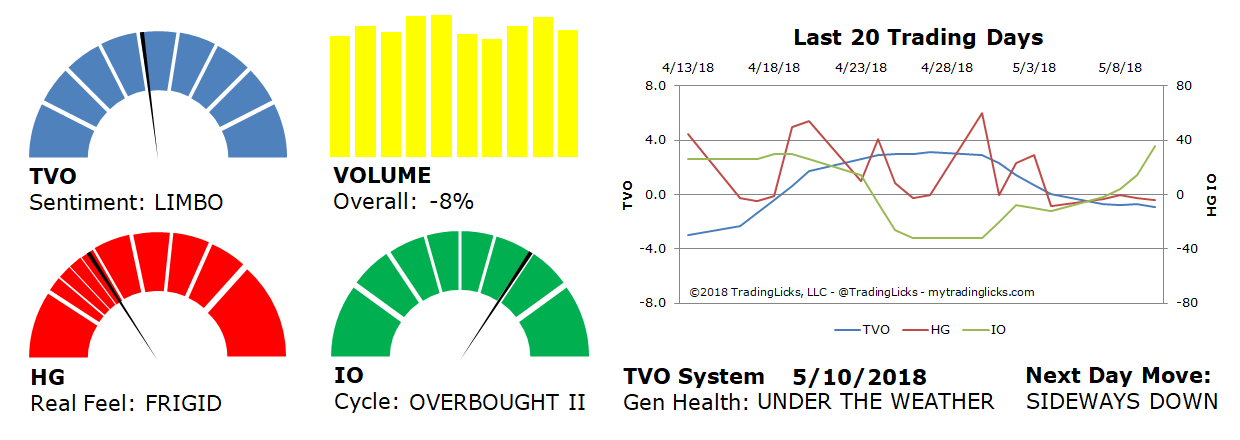

TVO Market Barometer 5-10: What is causing markets to go higher?

After a brief “selling in May” (which really started in late April), markets took off on Wednesday this week, logging the month’s first across the board accumulation day. On Thursday, despite the confusion of most network news folks, things went even higher pretty quickly and the top callers are now back in full force.

What may seem like a surprise to many, as far as volume is concerned, TVO already saw it coming. Tuesday’s rare occurrence of HG finishing flat on high volume (+10%) gave an indication of “churning” beneath the surface. Big volume churning means big institutions are clearly behind the ball re positioning themselves for what’s almost always followed by a big move.

It may look like markets need a breather, but the shorts better not hold their breath for too long. If you think that markets “need to correct” remember that while the VIX continues to drop, a “correction of time” remains a strong possibility. Just like a Tesla flying through space, in the absence of friction (which equates to resistance levels and moving averages in charting terms), momentum from take off will keep things moving along much longer than you think, so fasten your seat belts. -MD

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.