TVO Market Barometer 11-12: It’s always hopeless before the reversal.

The expected “after the Fed shake-out” came right on schedule and drove markets back down to levels that took most bulls (including myself) a bit by surprise. But they call it a shake-out for a good reason, and if it didn’t rattle most folks, it just simply wouldn’t be as effective.

Our account did take a sizable hit, but our long-term position and thesis for more upside is still intact. In fact, TVO, our long-term volume oscillator, has now shifted into BUY mode. As long as it remains between 0 and 3, history has shown it’s a good time to contribute to long-term portfolio investments.

You’re probably thinking, “the market has slapped me down one too many times… there’s no way I can be bullish now, I’m out.”

Well, just as it’s always darkest before the dawn, in the stock market it’s always hopeless just before the reversal. That’s not to say that there aren’t times when you should quit, but if you know your system is sound, things will turn around. And that’s why we spend countless hours monitoring and making sure TVO continues to perform within a 60-80% win rate.

Staying above 60% is understandably a good idea, but why not go for 85, 90 or even 100%?

Well, for every win there’s always someone who took a loss on the other side of the trade. The market needs players from both sides to continue to exist. If you win too much, the folks on the other side will eventually get fed up and leave the table, leaving you and your 90 to 100% win rate strategy worthless.

So the methods of those who claim to continually “crush the market” on a daily basis are inherently short-term ventures at best. If you’re one of those traders, congrats, but you may want to enjoy it and bank those returns while it lasts. Being on the wrong side of a trade is never easy, however, if you’re in it for the long haul (which is the only sure way to build wealth in the market), being right all the time is a far more dangerous thing. -MD

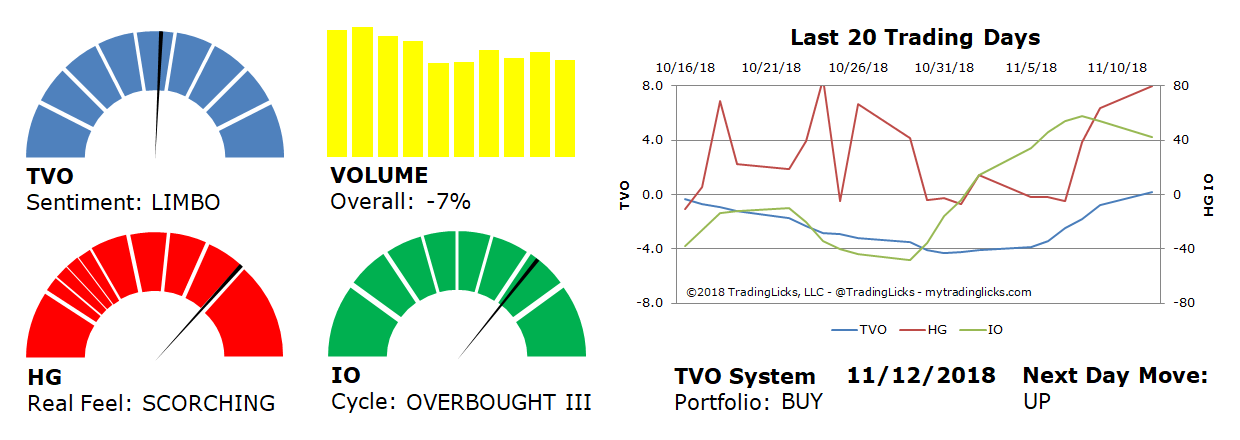

Sentiment: LIMBO – Markets are neutral and sentiment can go either way from here.

Volume: -7% – Today’s volume was lower than the previous session.

Real Feel: SCORCHING – Bears dominated the session with a minuscule amount of buying under the surface.

Cycle: OVERBOUGHT III – Retail investors have bitten off way more than they can chew.

Portfolio: BUY – The market is healthy and it’s a good time to contribute to long-term investments.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 60%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.