TVO Market Barometer 10-31: Every bear has its day.

The dreaded month of October is now in the rear view mirror, and, as fate would have it, markets managed one last October surprise and logged an across the board volume accumulation day.

They say here in New England, “if you don’t like the weathah, wait a minute”, and the same goes for the stock market. For the bulls, that minute has been a painfully long month dominated by distribution days, but now relief is finally in sight. The bears, on the other hand, have been waiting for this moment for what must have seemed like an eternity… and for those who played it right, it was well worth the wait.

But just as important as knowing when to catch the ride down, is knowing when to step aside and let the nature of the market (which by design is to go up) take its course.

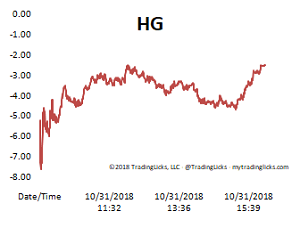

TVO has quickly descended into negative territory, but a recent shift in volume has slowed things down a bit and could result in a reversal in oscillator values. When that happens, well, let’s just say that TVO’s track record of calling market bottoms (which includes the ’09 bottom almost to the day) is quite a bit more reliable than a certain ominous indicator that almost always rears its ugly head around this time of year.

Will things just go straight up from here? Of course not. There will always be shake-outs and re-tests of prior lows, but once volume kicks in and big institutions start to take control of the wheel, the best place to be is along for the ride. -MD

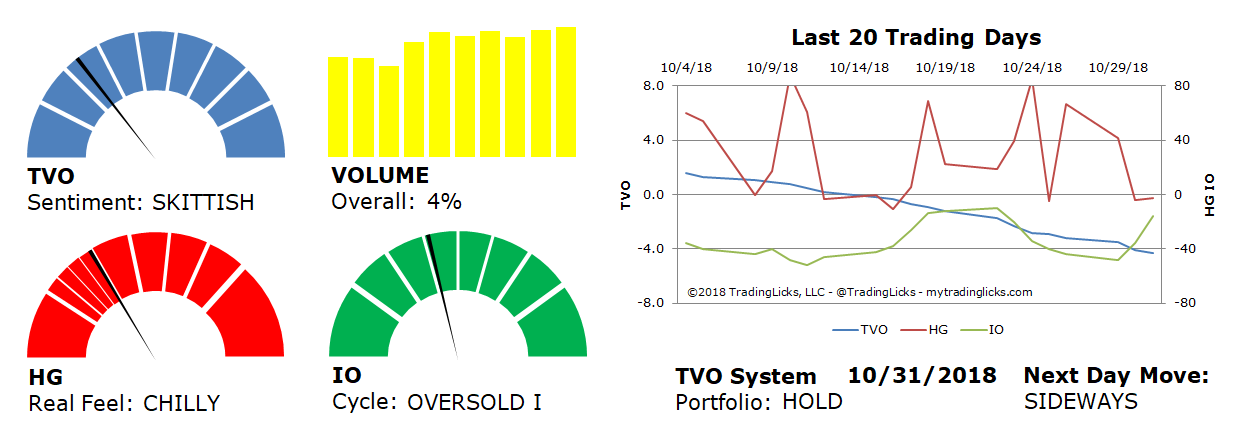

Sentiment: SKITTISH – Market distribution is heavy and aggressive and big institutions are selling to preserve their capital.

Volume: 4% – Today’s volume was higher than the previous session.

Real Feel: CHILLY – Bulls were in control of the session with substantial selling under the surface.

Cycle: OVERSOLD I – Retail investors are uncertain and very light in their holdings.

Portfolio: HOLD – The market is in a period of indecisiveness and the best place is on the sidelines.

Next Day Move: SIDEWAYS -Â The probability that SPY will close positive in the next session is 53%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.