How could there possibly be more buyers? – TVO MB 2-06

After 5 straight sessions of sub-zero temps on the Heat Gauge, the market finally turned up the heat on Wednesday, although not by much. It may be just enough declining volume, however, to create a vacuum for more buyers.

Wait, more buyers you say? How is that possible?

Well, those that fear the 200 day MA for its “bear market below it” properties, seem to forget that there’s also another camp out there that thinks “all is well and good above it”. And those folks have been behaving like they’re already above it for over a month now.

This is a camp I would not want to mess with (And I’m not talking about the PPT). While you’re busy trying to decide if this rally is a dead cat bounce (yes, some actually still believe it is), they will make sure SPY hits 274-275 and beyond… well before (or if) it heads back down to 267. -MD

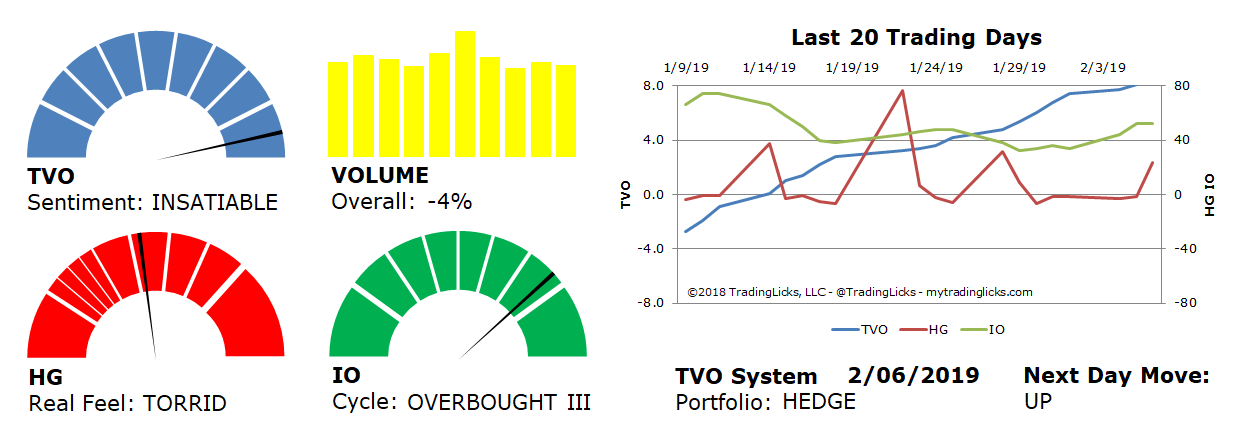

Sentiment: INSATIABLE – Big institutions are buying like there’s no tomorrow.

Volume: -4% – Today’s volume was lower than the previous session.

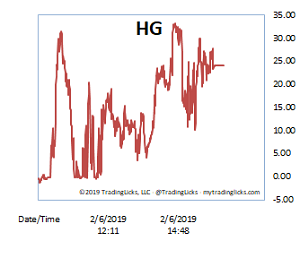

Real Feel: TORRID – Bears were in control of the session with moderate buying under the surface.

Cycle: OVERBOUGHT III – Retail investors have bitten off way more than they can chew.

Portfolio: HEDGE – The market is over saturated and long-term investments warrant some protection.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.