Are you too smart to trade? – TVO MB 3-04

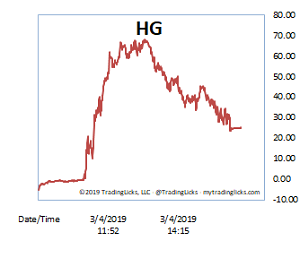

The gap at the open on Monday gave the bears their double top on SPY (it actually overshot by about 50 cents, but who’s counting). The shorts gave up the ship, however, just shy of the 276 gap. Comparably, the Heat Gauge quickly heated up after the open, but didn’t stay that way for long.

Many folks were scratching their heads trying to figure why the market sold off today. Well, the reason is the same as why it was quickly bought up later in the session… supply and demand. You really don’t have to dig any deeper than that.

But the need to have things “make sense” usually results in traders suddenly putting emphasis on things like the Nikkei and the Hang Seng index, as if now they suddenly matter. So-called “smart” folks who exhaust all their resources searching for answers, often miss the obvious that’s right in front of their nose.

One of our members pointed out to me today that a certain trader’s analysis of On Balance Volume (OBV) showed a peak in volume and a turn towards distribution on the S&P 500 2 weeks ago. TVO picked up a similar shift when the oscillator reversed almost a month ago, but a volume shift is very rarely a black and white affair.

Just because the accumulation is winding down, it doesn’t automatically mean a distribution phase has begun. But again, this doesn’t stop people from trying to make sense of it.

What about the selling now after today’s dive? Like I’ve said before, when distribution days are virtually non-existent (2 total in the entire month of February), there are virtually no reasons to go short or stay in cash.

And as far as volume, OBV is a bit of a misnomer, as ordinary price data is used in its calculations. It can be a useful tool, but as with any tool, the person wielding it has to know where to tap. -MD

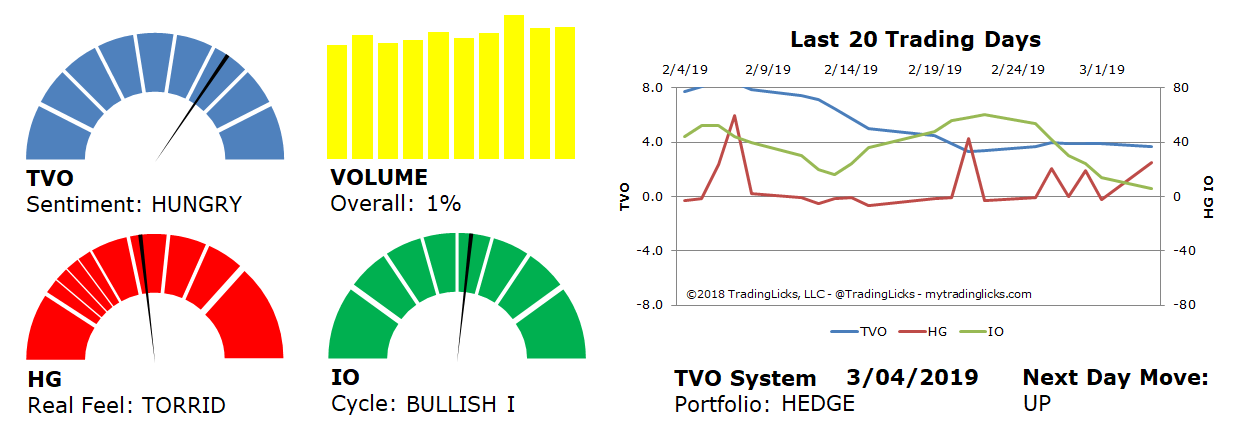

Sentiment: HUNGRY – Markets are accumulating at an accelerated rate and big institutional buying is heavy and aggressive.

Volume: 1% – Today’s volume was higher than the previous session.

Real Feel: TORRID – Bears were in control of the session with moderate buying under the surface.

Cycle: BULLISH I – Retail investors are confident and slightly overweight in their holdings.

Portfolio: HEDGE – The market is over saturated and long-term investments warrant some protection.

Next Day Move: UP -Â The probability that SPY will close positive in the next session is 59%.

Want to read more? Join our list. It's free.

For the full rundown on today's active signals and options trades, please log in. Not a Member? Join us today.

To view past positions check out our Trade History.

To find out what the indicators mean, visit our Market Volume Volume Barometer.

To learn more about market volume and how we trade, find us on Twitter (@TradingLicks) and StockTwits!

The indicator descriptions in the above graphic represent general market sentiment. The actual TVO System signals and trades are listed below in the Members Area. To view, please Login. Not a Member? Join us.